Following up on Matt’s post – Decision Analysis – let’s take a look at using Osparna’s platform for Multi-Criteria Decision Analysis of an investment opportunity.

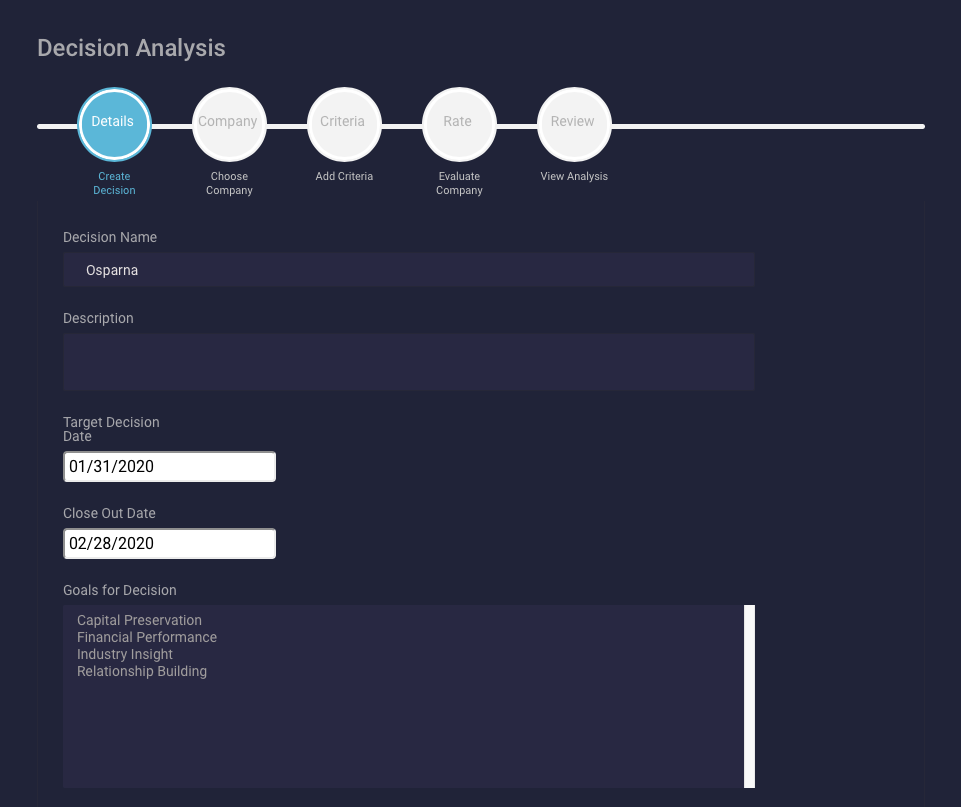

Decision Analysis: Details

The first step is to define the timeline for your decision: what is your target date and when does the opportunity to invest close? Optionally, you can enter a description of the decision to be made. Osparna encourages documenting the desired outcome (goal) of an investment decision so we’ve included an easy way to do so.

We know that investment decisions are made for many reasons: some financial, some strategic and others to strengthen a relationship. Being clear on your expectations up front allows you to later determine if they were ultimately met.

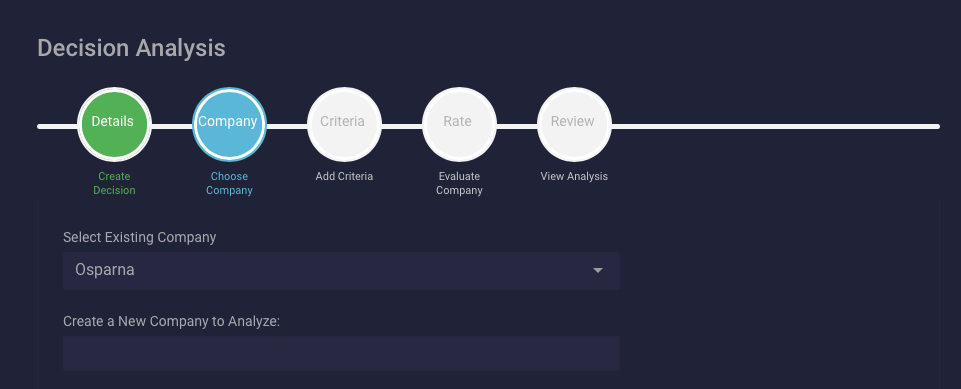

Decision Analysis: Company

The next step is to select the company to be analyzed. If the company isn’t already in Osparna it is simple to add it.

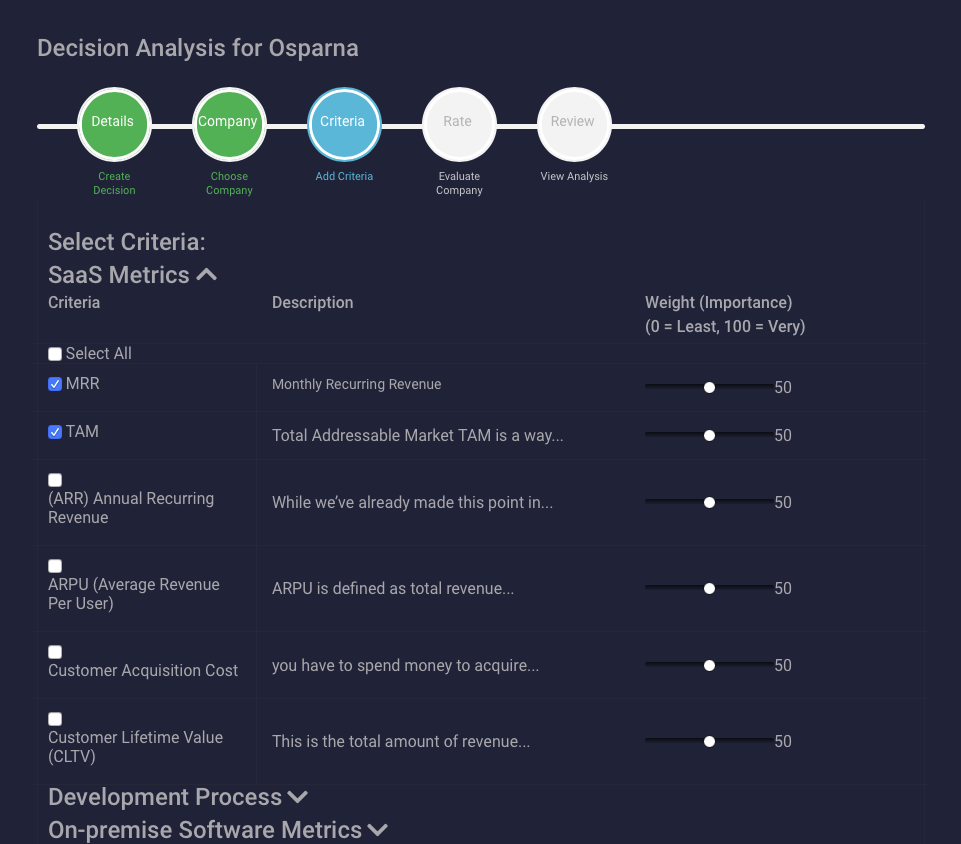

Decision Analysis: Criteria and Weights

Criterion are grouped into Criteria Sets in Osparna. You can select an entire set for use in the analysis process or individual criterion from a set. Initially, the weight for a criterion is set at its default value.

Weight is an indication of the criterion’s importance for this particular decision. Reduce the weight when the criterion will have less impact on your final decision, increase it when the criterion is a major deciding factor.

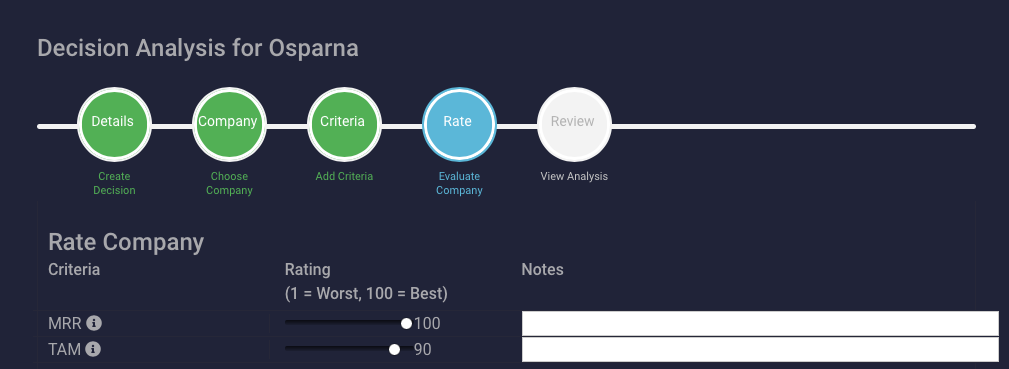

Decision Analysis: Rate

Once the criteria have been selected and the weighting determined, the next step is to rate each or accept the default rating. Optionally, a note for each rating can be made to provide colleagues with insight into your analysis.

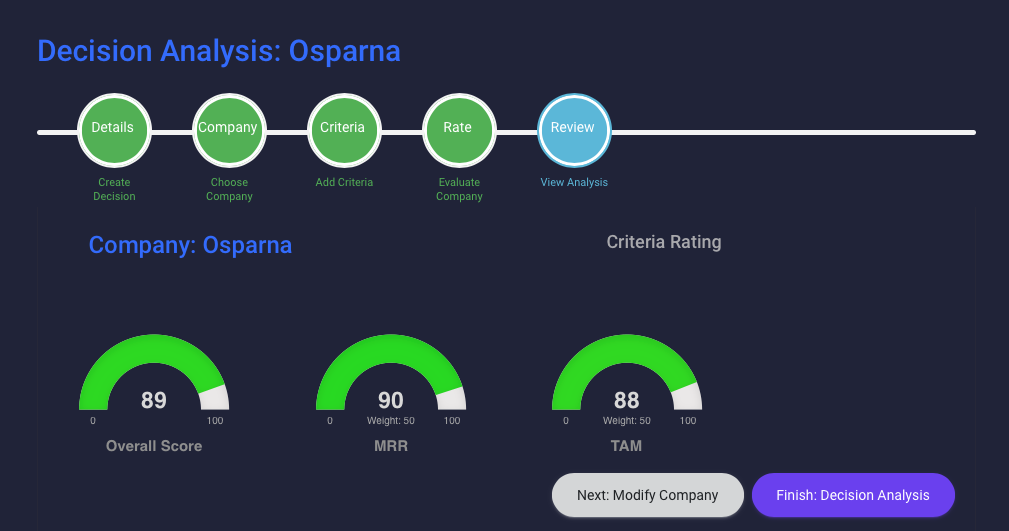

Decision Analysis: Review

In the final step of the Decision Analysis process Osparna presents a visual representation of the rating and weight for each criterion. An overall score, scaled 0 – 100, is calculated for the company using the Weighted Sum Model analysis approach.

While decisions can be based on human intuition, decisions can be improved over time only if the process by which they are made is made explicit and analyzed. – Matt McKnight

That’s it, you have now successfully analyzed a company using Osparna’s diligence application. Osparna guides you through each step of the quantitative analysis process using your criteria. From here, qualitative insights can be added to the analysis for inclusion in the Decision Analysis Report. More on that in a subsequent post.

Of course, we’ve only highlighted a few features of Osparna’s platform in this post. Contact Us to schedule a demo.